fresh start initiative expires

This initiative also increased allowable living expenses and changed the way applicants financial situations were analyzed to make this program more accessible for many taxpayers with outstanding tax debts. The program is designed to help individuals and small businesses with overdue tax liabilities and it also has the benefit of helping the IRS by removing taxpayers from its vast collection inventory.

Bankruptcy Fresh Start Program The What And Why Day One Credit

If a taxpayer can pay the outstanding debt within 6-years or the term of the collection statute whichever is shorter the IRS may allow discretionary expenses.

. The changes made as a part of the Fresh Start Initiative were designed to help. In fact it goes as far back as 2011 but at that time is was referred to as the Fresh Start Program. The term Fresh Start Initiative is more fitting than Fresh Start Program since the Fresh Start Initiative isnt a new program that stands separately from existing tax laws.

Under the new rules the IRS does not issue tax liens if the tax owed is less than 10000. The program emphasizes facilitating. Individual results may vary based on ability to save funds and completion of all program terms.

2 days agoBiden extended the pause on student-loan payments a fourth time through August 31. Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. The debt must be paid off within 5 years 60 months or before the CSED Collection Statute Expiration Date expires whichever occurs first.

IRS Installment Agreements. So in short the Fresh Start Initiative is still in place in 2019. The IRS began Fresh Start in 2011 to help struggling taxpayers.

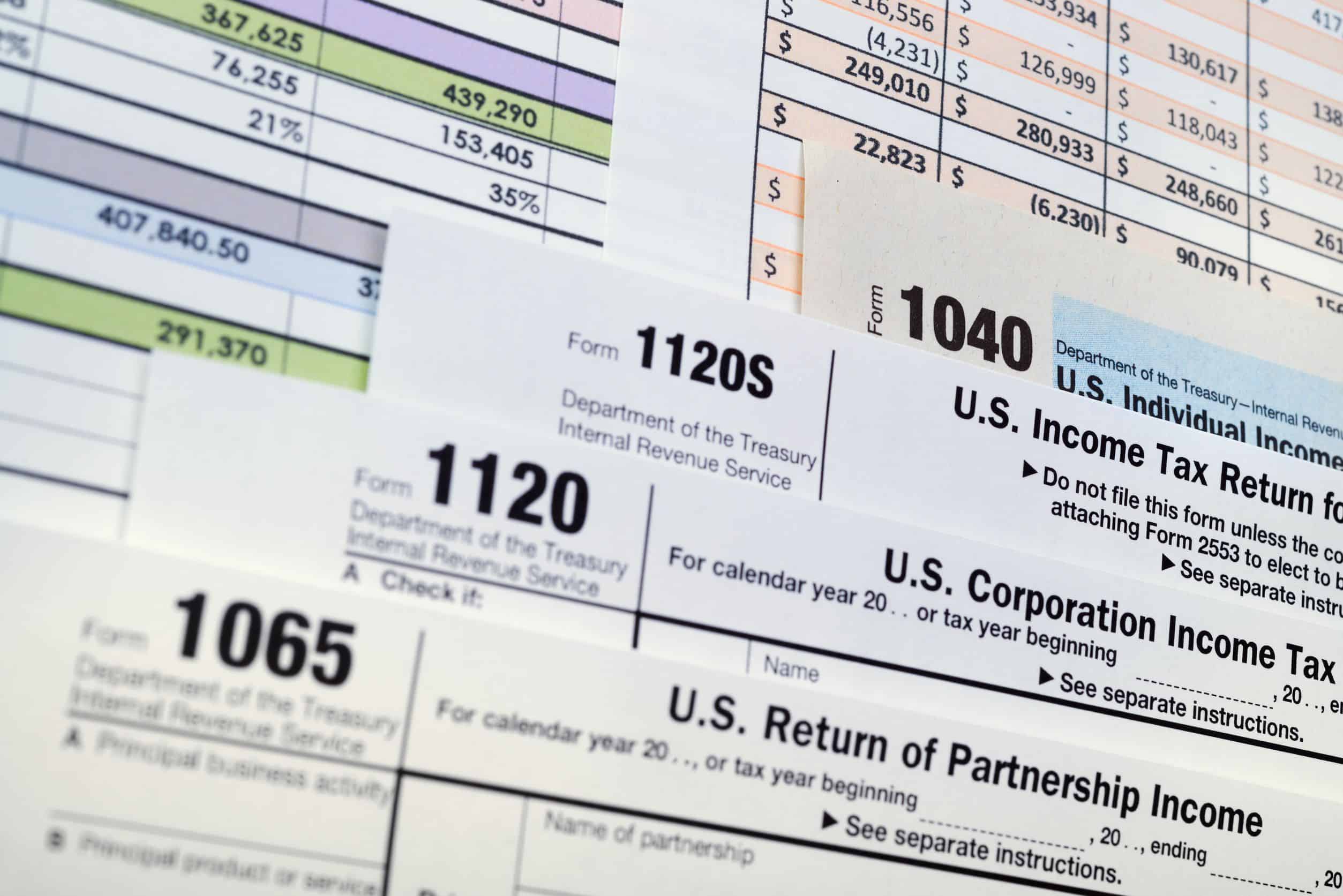

The two most common repayment options under the Fresh Start Program are extended installment agreements and Offer in Compromise OIC. Also you can request that the lien be withdrawn if youre an individual who owes less than 25000 and agrees to pay the IRS every month via an automatic bank account debit and pays for three consecutive months under the direct-debit installment. If youre experiencing or worried about liens levies garnishments or more now is the time to learn about your options to protect yourself and resolve your tax burden.

Program does not assume any debts nor provide legal or tax advice. Taxpayers have lost their jobs and small businesses have seen a dramatic decrease in their revenue due to the forced shutdowns. Thanks to the Fresh Start Program it is now easier for taxpayers to qualify for a streamlined IRS installment agreement.

The coronavirus has impacted many individuals and businesses. The IRS began the Fresh Start program in 2011 to help struggling taxpayers. Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability levels.

Instead its an initiative that changed numerous elements of the tax code. Expanded Penalty Relief Now expired IRS Fresh Start Tax Lien Changes. The IRS launched the Fresh Start initiative in 2011 for the purpose of helping more taxpayers to get back in good standing.

IRS Fresh Start programs under federal law provide real relief but they can be very complexed to navigate. The tax debt threshold change from 5000 to 10000 was a significant win for. This program allows people to make a one-time payment of their IRS tax debt and avoid penalties and interest.

As with regular installment agreements Fresh Start payment plans require a taxpayer to be in current compliance with filing tax withholding andor estimated tax payments. Now with the Fresh Start program taxpayers can pay off their tax debts through the different IRS-approved installment plans. Here we go through the basics of the IRS Fresh Start Program and where things are at in 2021.

Now you have to owe 10000 or more before the IRS places a lien on your property. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt. January 6 2022.

While this was. The IRS calls these expenses conditional expenses meaning taxpayers can have them allowed on the condition that they pay within 6 years. The IRS Fresh Start Program isnt just for your benefit.

Under the IRS streamlined payment plan debts must be paid within the 72 month payment period or prior to the Collection Statute Expiration Date CSED whichever is earlier. While there have been changes to IRS procedures after the Fresh Start Initiative was enacted these have generally only served to expand the benefits of the Fresh Start Initiative. The Fresh Start Initiative eliminated the dollar limitation imposed on taxpayers requesting an Offer in Compromise.

This blog post will introduce what the IRS Fresh Start Initiative is about and how it works. IRS Installment Agreements and Fresh Start. Layette Program Provides basic clothing needs for newborns for new moms in need.

If you are a US taxpayer or have IRS tax debt you may be eligible for the IRS Fresh Start Initiative. Note that there are rare exceptions to this rule. The reality is that the Fresh Start Initiative is not new.

Not available in all states. This was in recognition of those who were hit hard by the 2007 Subprime Mortgage Loan recession continuing to the modern. The Fresh Start Initiative now allows for tax liens to be withdrawn once a taxpayers IRS debt is paid below the 10000 threshold.

Many people wonder if the Fresh Start Initiative is still in place today in 2019. This is to help willing taxpayers pay off debts without any undue financial hardship. Economists say that the impact will be felt for many years to come.

IRS Fresh Start Qualification Assistance. If so the IRS Fresh Start program for individual taxpayers and small businesses can help. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien.

Fresh Start made it clear. Clothing Program Through a referral clients can shop at no cost in the Lots of Clothes store. The Fresh Start Program increased the debt threshold that triggers a tax lien.

This expansion included the following changes. That amount is now 10000. It is for the IRS.

IRS Fresh Start Program Guide With 2021 Updates. This expansion will enable. The IRS Fresh Start Program may help you resolve your federal tax liabilities.

Read and understand all terms prior to enrollment. It offers varying levels of relief and repayment options based on the specific financial situation of each applicant. Both of these facts could be further from the truth.

If you you have tax debt you have undoubtedly heard a lot about the Fresh Start Initiative FSI in radio ads TV advertisements online and more. Many of these advertisements will make you think that the IRS has some special program or that it is some recent change the IRS made. However in some cases the IRS may still file a lien notice on amounts less than 10000.

Previously 5000 was all it took to find yourself on the business end of a notice of federal lien. The initiativeprogram was initially implemented with the objective of providing taxpayers with a first-time tax liability an opportunity to make things right again by providing expanded options toward securing. He also announced defaulted borrowers would get a fresh start and return to good standing.

The Fresh Start Program is a collection of changes to the tax code. The IRS Fresh Start s a bit of a win-win --- the initiative makes it easier for individual and small. Fresh Start Provides basic household goods including Dignity Bags for those who have experienced home displacement for a variety of reasons.

BEFORE FRESH START INITIATIVE EXPIRES. The payment option may be as long as 72 months or six years. The Fresh Start Initiative eliminated the dollar limitation imposed on taxpayers requesting an Offer in Compromise.

How To Find Csed Irs Wilson Rogers Company

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Tax Lien What It Is And How To Stop One Clean Slate Tax

Bankruptcy Fresh Start Program The What And Why Day One Credit

The Irs Tax Debt Forgiveness Program Explained

Top 13 Questions About The Irs Fresh Start Program Tax Relief Center Start Program Tax Debt Relief Fresh Start

The Tax Help Guide Ultimate Resource For Tax Help Questions

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Bankruptcy Fresh Start Program The What And Why Day One Credit

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Offer In Compromise Fresh Start Program Solutions For Tax Debt Problems

What Is The Irs Fresh Start Program 72 Month Installment Agreement

Back Taxes And Tax Debt Tax Tips And Resources

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit